Housing affordability in Switzerland

Data sources: BFS STATPOP (21), SE (21), ZAS, HABE (15-17)

A current analysis shows the affordability of housing in Switzerland and the considerable differences depending on the measurement approach. The proportion of households with unaffordable housing varies between 6.7% and 26%. This analysis sheds light on the influencing factors and provides recommendations for the planning of affordable housing.

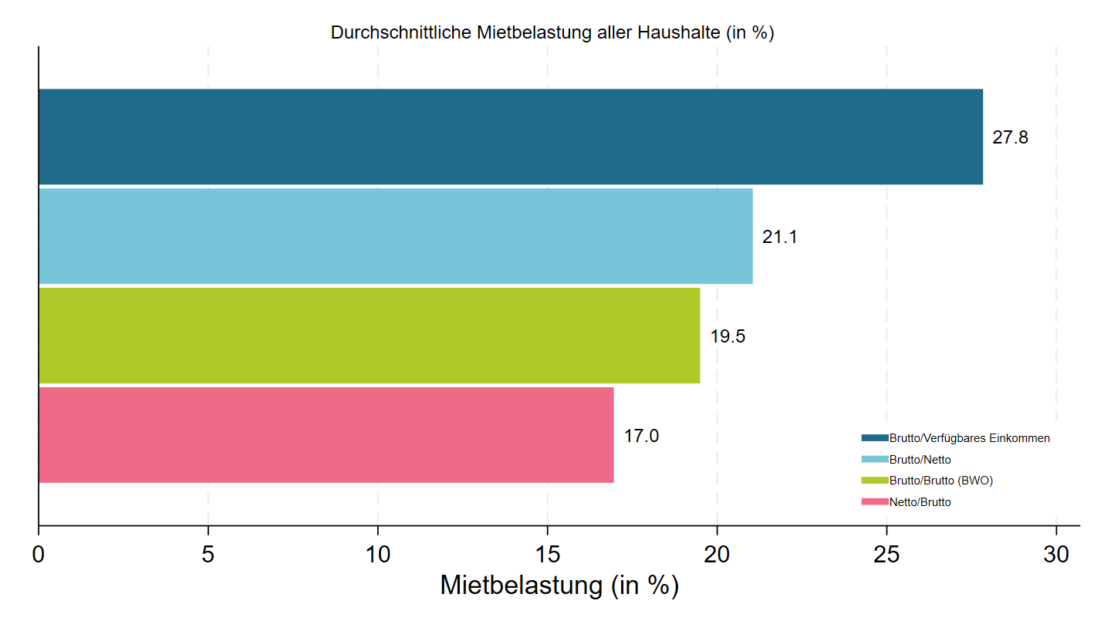

The average rent burden of all households in Switzerland is between 17% and 27.8%, depending on the definition of the ratio approach. The analysis shows that the assessments of the unaffordability of housing vary considerably depending on the measurement approach chosen: The proportion of households for whom housing is unaffordable ranges from 6.7% to 26%. These differences emphasise the need for a differentiated view of the housing cost burden.

Influence of income class and household type

The differentiation of households by income class and household type has a considerable influence on the rent burden. Households in the lowest income quintile spend up to 51% of their disposable income on gross rent, while households in the top quintile pay a maximum of 17.2%. Single households over 65 in the lowest income quintile are particularly badly affected, with a rent burden of up to 64%.

Ratio approach as the preferred method

The ratio approach, which measures the housing cost burden as a proportion of income, is considered more practicable than the theoretically optimal residual income approach. The differentiated ratio approach, which varies by income class and household type, allows a more accurate assessment of housing affordability and is more applicable than pure rental cost benchmarks. Granular data on population, income and housing support this differentiated analysis.

Need for a clear definition and further research

The concept and objectives of affordable housing planning must be clearly defined. Owners and developers can only create targeted offers if precise thresholds for different household types and income brackets are available. Future research should focus on determining appropriate thresholds and clarifying which specific components of housing costs and income should be considered in the affordability analysis.

Optimising pricing to encourage investment

Differentiated pricing based on actual incomes can reduce vacancy and letting risks and encourage investment in new housing. The application of a differentiated ratio approach provides a solid basis for assessing housing affordability in Switzerland and contributes to the creation of sustainable and affordable housing.