Turnaround in interest rates not curbing rise in real estate prices for the time being

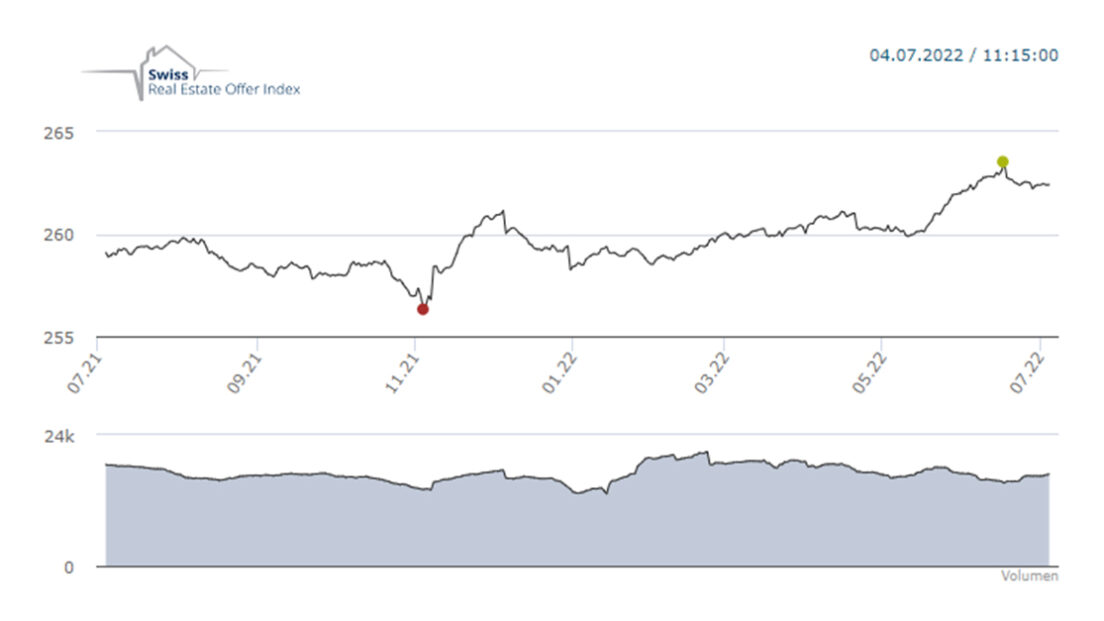

Rising interest rates are making mortgages more expensive and making real estate investments less attractive. This could have a negative impact on demand. However, there are currently no signs of a trend reversal in house and apartment prices, as the Swiss Real Estate Offer Index shows.

Will the real estate price rally in Switzerland come to an end with rising interest rates? In June there were no signs of a turnaround, at least on the supply side. On the contrary: sellers of condominiums increased their price expectations by a further 1.1 percent within a month. Providers also demanded higher prices for single-family homes in June. However, the surcharge is somewhat lower at 0.3 percent, as shown by the Swiss Real Estate Offer Index, which is compiled by the SMG Swiss Marketplace Group in cooperation with the real estate consulting company IAZI.

It remains to be seen whether the willingness to pay will continue to follow the rising price expectations. This does not seem out of the question, as mortgage costs are by no means the only criterion when buying a home. In addition, unlike Fix mortgages, money market mortgages are still available at extremely attractive conditions. Since prospective buyers already have to demonstrate that they can cope with a mortgage interest rate of around 5 percent due to the applicable affordability rules, a collapse in demand is not to be expected.

Unchanged rents in June

The rental prices offered in advertisements hardly changed at 0.1 percent in June. Asking rents are primarily influenced by the direct demand for living space. This is in contrast to existing tenancies: there could be increases due to the fact that tenancy law is linked to the reference interest rate and general inflation. “The high energy prices are likely to have a far greater impact on asking or existing rents than rising interest rates. Not least in the case of old buildings, these will lead to a significant increase in ancillary costs,” says Martin Waeber, Managing Director Real Estate, SMG Swiss Marketplace Group.