Milestone of transparency on greenhouse gas emissions of the real estate industry

Transparency is an effective means of preventing greenwashing. The trend in the real estate sector is therefore towards the disclosure of important environmental indicators. REIDA, a non-profit association supported by the industry, supports this trend and has developed a standard for calculating these key figures. In this way, property portfolios can be compared comprehensibly in terms of energy consumption or greenhouse gas emissions. In 2022, almost 4000 properties were benchmarked in this way for the first time.

With a share of 23.9%, real estate is the third largest source of greenhouse gas emissions in Switzerland after transport and industry. There is therefore no way around sustainable real estate to achieve the net-zero climate targets. However, you can’t tell by looking at real estate whether it is environmentally friendly or not. Labels and ratings were therefore created early on to provide information about the sustainability of real estate.

Comparability is central

What initially contributed a lot to the promotion and better understanding of the sustainability of real estate has meanwhile become a problem itself. The variety of labels and initiatives in the sustainability field overwhelms many market participants. Moreover, the individual ratings can hardly be compared with each other. Some ratings include several dozen indicators, so that in the end it is no longer clear what they are trying to express at all. Moreover, many investment vehicles in the real estate sector are now labelled as sustainable and apply ESG criteria, but there is no clarity as to how sustainable the respective properties are.

The trend is towards disclosure of environmental indicators

However, investors are demanding increasingly precise information and want to be able to compare different investment products not only in terms of returns or risks, but also in terms of sustainability. The trend today is therefore towards direct disclosure of environmental indicators, such as energy consumption or greenhouse gas emissions. Last year, the AMAS and KGAST associations obliged or requested their members to publish the most important key figures in the annual reports of real estate funds and real estate investment foundations with a closing date from the end of 2023.

Why do we need a standard?

However, calculating these key figures is anything but simple. Different values can result for the same properties, depending on the calculation method. Standardisation is therefore necessary. REIDA has taken on this task and developed a standard for determining the most important environmentally relevant key figures in the real estate sector. According to this REIDA standard, a benchmarking was carried out in 2022 with 3984 existing properties or 36 property portfolios, which have a total of almost 23 million m2 of energy reference area.

What was measured?

Only consumption values measured in real terms were recorded and balanced. This is a big difference to other surveys, where in many cases no consumption data is available and which therefore mostly operate with calculated values (estimates based on benchmarks). For each of the real estate portfolios, the degree of coverage is also shown together with the results. This describes the proportion of properties in the portfolio for which measured energy consumption data are available. On average, the coverage rate for all 36 portfolios is 83.1%. The disclosure of the degree of coverage also serves transparency, but is still not widespread. An analysis of the annual reports of listed real estate funds by pom+Consulting in 2022, for example, showed that only 25% of them contained quantitative information on the degree of coverage.

Benchmarking results and their classification

The average energy consumption in the REIDA benchmarking portfolio is 97.4 kWh per m² of energy reference area. The range is between 59 and 146 kWh/m². Special situations are probably responsible for portfolios at the lower end of the values – e.g. that single tenants purchase a lot of energy themselves, which according to the current methodology is not yet taken into account in the energy indicator. In an online survey by the University of Lausanne, which analysed 66 portfolios of institutional investors with a good 31 million m² of building space, a somewhat higher value of 105.5 kWh/m² of energy reference area was reported for the reference year 2020 – but without using a uniform calculation methodology.

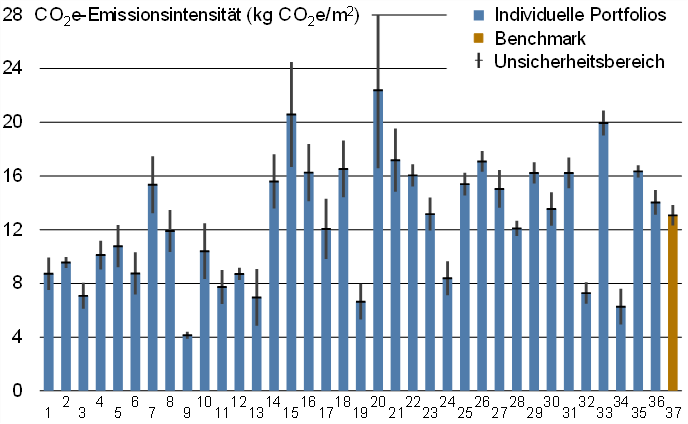

The share of renewable energy in the REIDA CO2 benchmarking is 25.8% on average, with a range of 13% to 54%. On average, the greenhouse gas emissions of the portfolios that participated in the REIDA benchmarking amount to 13.1 kg CO2 equivalents per m² energy reference area. In addition to carbon dioxide, the benchmarking also takes into account all other greenhouse gases, such as methane or nitrous oxide, and calculates CO2 equivalents (CO2e) from them. The REIDA portfolio 2022 thus achieves a very good value – with a range between 4.1 and 22.4 kg CO2e/m². The sample surveyed by the University of Lausanne achieved an average value of 19.6 kg CO2e/m². Again, due to the lack of a uniform calculation method, a direct comparison is only possible with reservations.

Specification of uncertainty ranges

Another achievement of the REIDA benchmarking is the specification of uncertainty ranges. This is because the consumption and emission values used as well as the calculations are always subject to uncertainties (e.g. inaccurate measurement sensors, small conversion uncertainties from lettable area to energy reference area). These uncertainties are aggregated for each portfolio and shown at the level of the key figures in the form of an uncertainty range, which indicates how reliable the key figure is. The uncertainty range is given as twice the standard deviation, which means that the actual value lies within the specified uncertainty range with a probability of 95%. For the indicator of CO2e emission intensity, the individual portfolios show uncertainty ranges from 0.3 to 5.8 kg CO2e/m².

New standard for ESG reporting in Switzerland

With the CO2 benchmarking, REIDA sets a new standard and thereby achieves a milestone in the ESG reporting of real estate in Switzerland. The standard will not only be continuously improved in terms of methodology and data quality, but will also cover aspects of environmental sustainability that have so far been excluded. One of the most important tasks will be to cover not only the operating phase of real estate, but also its entire life cycle, and in particular to incorporate the issue of grey energy. The addition of ratings and certificates – which have limits in terms of transparency and comparability – as well as the transition to direct reporting of the actual key performance indicators are thus in full swing.