Home prices resilient despite sharpest interest rate rise in 30 years

The situation in the real estate market for residential property was exceptional in 2022 due to the strongest interest rate increase in 30 years. Nevertheless, it was robust overall with prices rising again, although the price momentum slowed down compared to the previous year. The number of property sales also declined. Here, the location played a central role in determining the price, as an analysis of the effective sales prices of the past year showed. A distance of only 35 kilometres as the crow flies was enough to be able to buy six single-family houses for the same price instead of one. Overall, an average increase of 5.7 per cent was observed for condominiums, and 4 per cent for single-family houses.

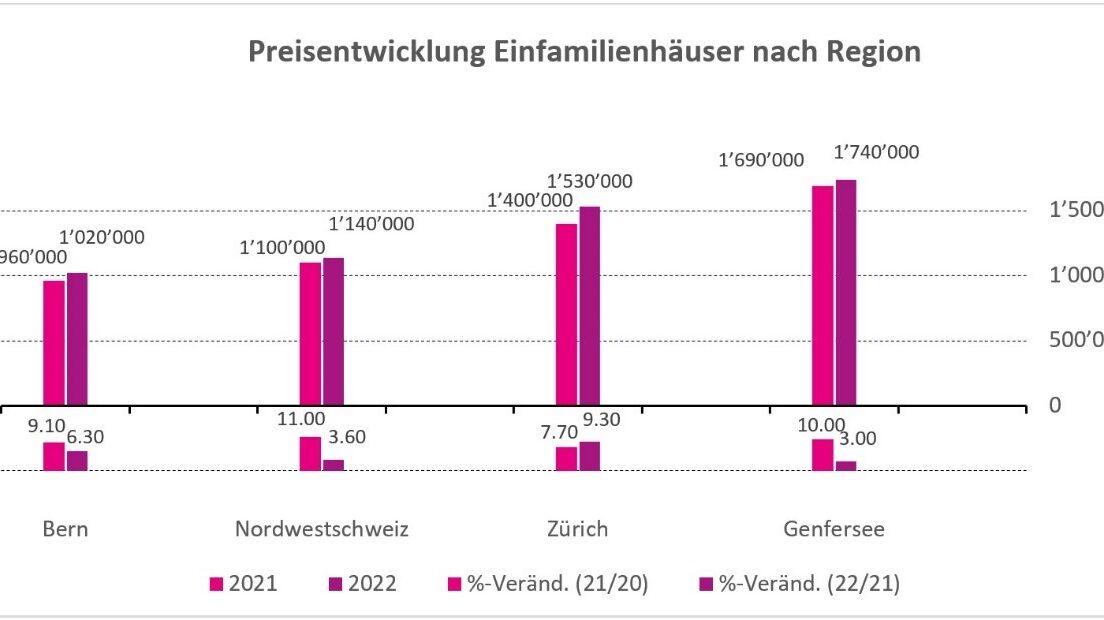

Prices for residential property increased again in nominal terms in 2022 despite the strongest rise in interest rates for 30 years, although much less strongly than in the previous year. In the case of single-family houses, prices increased by an average of 4 percent last year, which was significantly below the previous year’s value of 9 percent. In the same period, prices of condominiums increased slightly by 5.7 per cent – again, less markedly than in 2021, which equalled an increase of 8.3 per cent. However, a closer look at the four regions of Switzerland with the most transactions (purchases and sales of single-family houses and condominiums) – Zurich, Northwestern Switzerland, Bern, Lake Geneva – reveals a differentiated picture: Adjusted for inflation, only half of the regions still show a price increase for either single-family houses or condominiums.

The analysis by Homegate and ImmoScout24 together with the Swiss Real Estate Institute is based on the effective sales prices of the Swiss Real Estate Data Pool. This includes the owner-occupied properties financed by Credit Suisse, UBS and Zürcher Kantonalbank and covers around 40 percent of all transactions in Switzerland. In 2022, around 7,200 sales of owner-occupied homes were registered in the regions surveyed. As in the previous year, this represents a decline of around 10 percent compared to 2021, although in contrast to the previous year, this was largely reflected in the number of condominiums sold.

Martin Waeber, Managing Director Real Estate, SMG Swiss Marketplace Group, sees the reasons for the slowdown in price increases primarily in the sharp increases in key interest rates and the resulting rise in mortgage rates, as well as a declining effect of home offices compared to 2021: “The dampening effect of rising interest rates on the development of home prices predicted at the beginning of 2022 has been confirmed, albeit to a lesser extent than might have been expected. However, home prices seem to have slowly reached their zenith. Apart from the fact that many people simply can no longer afford to buy their own home at current prices, the declining use of home offices has also led to a decline in the valuation of the work situation within one’s own four walls. Both factors dampened the price increase in the course of the past year. However, in view of the scarcity of land and the continuing influx into Switzerland, a real estate bubble is not to be expected in this country, Waeber continues. This is especially true since properties for sale are still very popular, especially in places like Geneva and Zurich.

Single-family homes in the Lake Geneva region more than 70 percent more expensive than in the Bern region

With strong price growth of 9.3 percent, prices for single-family homes in the Zurich region increased the most in 2022 – and this was even the only region with a higher price increase than in 2021 with an increase of 7.7 percent. The average single-family home cost CHF 1.53 million. As a result, the Zurich region increasingly caught up with the Lake Geneva region, which remained the most expensive: the gap to the average single-family home price in the Lake Geneva region narrowed by CHF 80,000, or 28 percent, compared to the previous year. In the Lake Geneva region, an average property cost CHF 1.74 million in 2022, 3 per cent more than in 2021. In the Bern and Northwestern Switzerland regions, average property prices for single-family homes also converged somewhat, with prices in the Bern region recording an increase almost twice as high (6.3 per cent to CHF 1.02 million) as in the Northwestern Switzerland region (3.6 per cent to CHF 1.14 million). Taking into account last year’s inflation, this results in only a minimal price increase of 0.8 per cent for northwestern Switzerland. Nevertheless, Bern remains the cheapest region to buy a single-family home.

Condominiums in the Lake Geneva region almost as expensive as in the Zurich region

In the case of condominiums, growth in the Zurich region for 2022 was restrained at 3.7 per cent, especially compared to that of single-family homes. Nevertheless, properties in this region remain the most expensive of all four regions analysed, averaging CHF 1.12 million. Due to a considerable price increase in the Lake Geneva region of 12 percent compared to 2021, the difference to the front-runner narrowed significantly (from CHF 120,000 to CHF 40,000). The Bern region continues to be by far the cheapest for potential buyers of condominiums. Average prices here rose by only 2.9 per cent to CHF 0.7 million last year. Taking inflation into account, this region can even be said to have stagnated. In addition to the Lake Geneva region, the second cheapest region – northwestern Switzerland – was also unimpressed by rising interest rates and the declining trend towards home offices: prices rose by 7.9 per cent in 2022, even more than in the previous year (5.6 per cent). At CHF 820,000, an average condominium now costs CHF 60,000 more than in 2021.

With a view to the property prices per square metre of net living space, an additional effect is particularly evident for the Lake Geneva and Zurich regions. In the Zurich region, prices per square metre rose significantly faster than property prices in the same period. This indicates falling residential areas of the traded properties. In the Lake Geneva region, on the other hand, the opposite was true, i.e. property prices rose five percentage points more than prices per square metre. Thus, larger properties tended to be sold on the market in the Lake Geneva region for 2022 than in 2021.

The cheapest houses are in Aarburg, the most expensive in Uetikon am See*

Not surprisingly, of the five municipalities with the highest median prices for single-family houses, three came from the Zurich region. The most expensive are in Uetikon am See (CHF 4.0 million), followed by Kilchberg (CHF 3.68 million) and Meilen (CHF 3.41 million). These are followed by two municipalities in the Lake Geneva region, Vésenaz (CHF 3.06 million) and Nyon (CHF 2.98 million). Two findings are worth noting: firstly, all five of the most expensive municipalities for single-family homes were not listed last year; secondly, prices in this highest segment have risen significantly once again. In the case of the highest median prices for condominiums, all five municipalities even came from the Zurich region: led by Küsnacht (CHF 2.52 million), Zumikon, Herrliberg and Meilen (CHF 2.3 million each) and Erlenbach (CHF 2.16 million).

On the other side of the scale, the cheapest residential properties in the four regions surveyed – for both single-family houses and condominiums – all come from the canton of Aargau. Depending on the municipality, condominiums are priced from CHF 400,000 (Klingnau), while single-family homes could be purchased last year from CHF 610,000 (Aarburg). This shows impressively: for the price of a condominium in Küsnacht in Zurich, there are six to buy in Klingnau, less than 35 kilometres away. And almost seven single-family homes – or a complete apartment building – can be bought in Aarburg for the price of one in Uetikon am See. These two places are also just 60 kilometres apart as the crow flies.

Summing up the results of the latest Home Market Price Analysis, Peter Ilg, head of the Swiss Real Estate Institute, is amazed at how robust price growth is in the owner-occupied home market: “After nine years of negative interest rates, the turnaround in interest rates came abruptly last year with several key rate hikes totalling 1.75 percentage points. For the first time in more than 30 years, the SNB has raised the key interest rate so significantly within one year.” Falling home prices in Switzerland would therefore not have surprised Ilg at this turn of events – combined with a trend towards a decline in the use of the home office. “Nevertheless, I am amazed at how robust the price growth in the owner-occupied home market is: In three of the eight segments examined, price growth was even significantly higher than the previous year despite this headwind,” Ilg said, summarising the findings of the Home Market Price Analysis for 2022.