Direct investment as a driver of growth

Switzerland is one of the leading countries of origin and destination for direct investment. This strengthens the competitiveness of the economy and brings technological innovations and capital into the country. At the same time, direct investments are increasingly the focus of political regulation.

Direct investments are a central component of the global economy. They comprise equity investments in foreign companies with the aim of permanently influencing their business activities. The focus is on strategic control, market access and securing resources. In contrast to portfolio investments, which are primarily aimed at capital gains, direct investments have far-reaching economic effects for the countries of origin and recipient countries.

Switzerland’s locational advantages

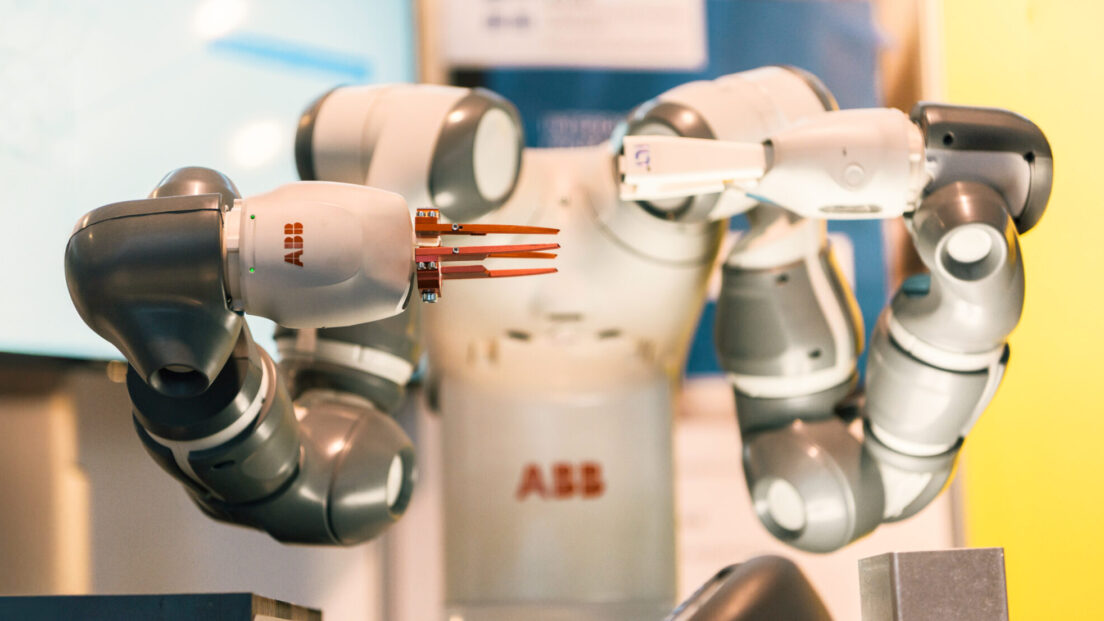

Switzerland is one of the most attractive investment locations in the world. Factors such as legal certainty, a stable economy, highly qualified skilled labour and a well-developed infrastructure make the country particularly attractive for multinational companies. Many international corporations such as ABB and Novartis have their headquarters here, while global companies such as Google and Liebherr have branches in Switzerland.

Global networking and economic effects

As an investor and investment location, Switzerland benefits from international capital flows. Swiss companies expand abroad through direct investment, while foreign investors invest in Swiss companies. This not only promotes the exchange of expertise and technologies, but also strengthens economic dynamism. The pharmaceutical sector in particular plays a key role in bilateral investment flows, especially between Switzerland and the USA.

Direct investments and their influence on growth

Direct investments have a measurable influence on economic performance. Capital gains from Swiss investments abroad flow back into the domestic economy and have a positive impact on consumption and investment. At the same time, foreign direct investment in Switzerland creates employment and increases productivity. in 2022, foreign-controlled companies accounted for around 24 per cent of total gross value added, while 11 per cent of jobs were directly dependent on them.

Increasing regulation as a challenge

In recent years, direct investments have been subject to increasing political regulation. Tax adjustments and investment controls are intended to create transparency and prevent tax avoidance. At the same time, there is a growing debate about tighter controls on takeovers by foreign investors, particularly with regard to national security interests. These developments could impair the growth potential of future direct investments.

Direct investment as a stabiliser and growth factor

Switzerland benefits greatly from direct investment, both as a country of origin and as a recipient country. It promotes innovation, strengthens economic power and secures prosperity. However, increasing regulatory intervention could pose long-term challenges for the global flow of investment and economic growth.