“Buy-to-let” A model calculation from the perspective of private investors

What are the main risks of a buy-to-let investment and how does this type of investment compare to alternative capital market investments? The author investigated these overarching questions as part of her thesis at the Center for Urban & Real Estate Management (CUREM) at the University of Zurich.

“Buy-to-let provides Swiss private investors with a way to participate in the real estate market and has enjoyed growing popularity in the wake of the low interest rate environment. The share of rented condominiums and single-family houses accounted for 17.0% of all newly concluded residential property financing in 2019 on a volume-weighted basis. This means that almost every sixth property was purchased with the intention of subsequently renting it out. In most cases, investments are made in condominiums and thus in smaller lot sizes due to the financial assets available.

The aim of the final thesis was to show private investors the main risks associated with a buy-to-let investment and to establish a relative comparison with alternative capital market investments. To this end, an investment analysis model was developed that looked at the profitability of a 3.5-bedroom condominium from its purchase in 2000 to its sale in 2020. Based on studies in various markets in the Bern area and by means of different sensitivities regarding the use of debt capital, their effects on the profitability ratios were illustrated.

Result

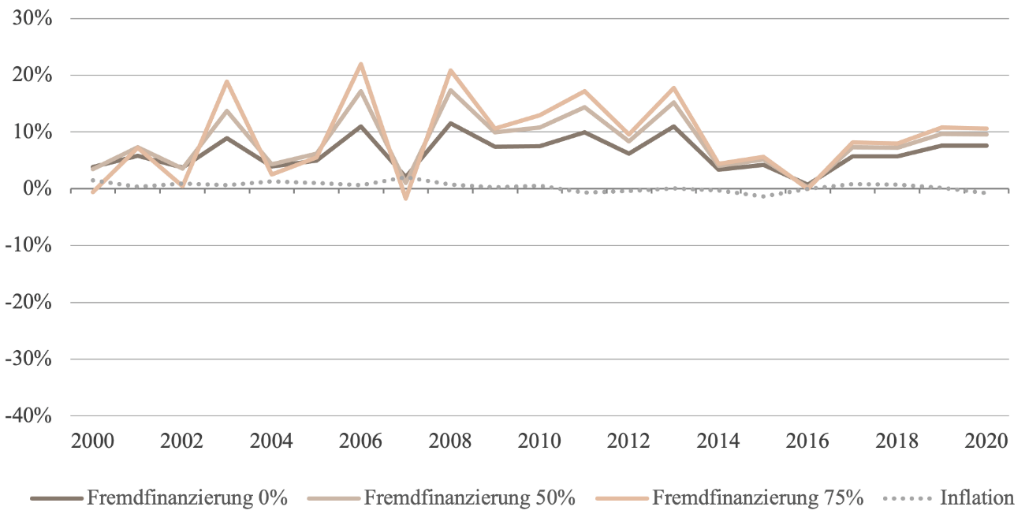

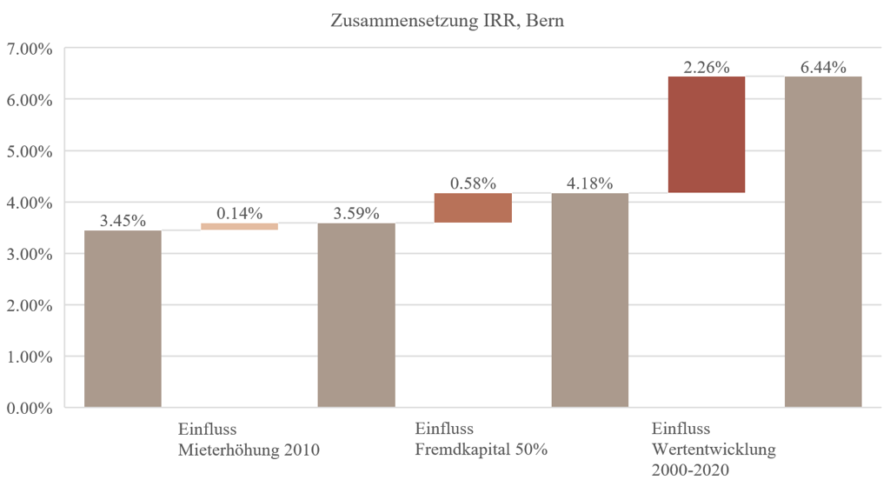

Risky investment strategy: With regard to the holding phase, it became clear that in particular the choice of the degree of debt financing and the prevailing interest rate level determines the achievable return on equity and at the same time also forms the highest expenditure item. In the first years of the holding period, a high leverage ratio of 75% and an average interest rate of 3.70% resulted in exclusively negative net returns. With regard to the sale of the property, it became apparent that the value development was the most significant determinant for the success of the buy-to-let investment (see Fig. 1). The potentially realisable market value is subject to cyclical fluctuations. Combined with an increased leverage ratio and the associated debt risk in terms of rising interest rates and possible losses in value, these factors constitute the main risk of the buy-to-let investment. If, in addition, a large proportion of the assets is tied up in a single property, this creates a considerable cluster risk, which is further increased by the effect of rising interest rates and losses in value. It is important to note that passing on rising interest rates to the tenant is only possible to a limited extent due to legal restrictions and the sluggishly reacting reference interest rate. In addition, higher interest rates are usually accompanied by rising inflation rates. Since residential rents are usually not fully linked to the consumer price index, inflation leads to a partly real reduction in rental income.

The consideration of the different markets – depending on the location of the property – also made it clear that the regional disparities can lead to large differences in the profitability and investment risk of the private investor and represent a further risk for the buy-to-let investment. With regard to the value retention of the property, the private investor should therefore primarily assess the location quality and the property.

Comparison of capital market investments

The comparison with the two asset classes Swiss equities and Swiss government bonds showed that the buy-to-let strategy could certainly represent an attractive alternative (cf. fig. 2+3). It was possible to further improve the return on the property over the period under consideration by using debt capital, but this was accompanied by a significantly higher risk (see Fig. 3). It should also be noted that the risk-return characteristics must be extended to include the variable of liquidity: In a weak economic environment, the sale of a property is only possible under timely circumstances and is usually associated with financial losses.

Conclusion

The decision for a buy-to-let investment should not be made lightly. A property purchase financed out of a lack of alternative asset classes and low financing costs often does not take into account the risks assumed at the same time. The property must remain effectively affordable in a higher interest rate environment and further capital gains should not be relied upon as an investment strategy. It can be concluded that rental income in particular determines the success or failure of the buy-to-let investment.

Personal details

Anissa Kühni, born 1991. Studied architecture at the Bern University of Applied Sciences, graduating in 2016. Master of Advanced Studies UZH in Real Estate, graduating in 2021. From 2016, active at Frutiger AG in project development for various site developments with a focus on “residential” as well as acquisitions. Since 2023 employed as project manager for real estate developments at Swiss Prime Site Solutions AG for the real estate fund “Akara Swiss Diversity Property Fund PK”.